UAE CORPORATE TAX: Taxation of Family Foundations

- Aug 22, 2025

- 7 min read

Updated: Aug 23, 2025

Introduction And Background

It is a common global practice for families to manage their wealth across generations by establishing a Trust, Foundation, or a similar entity.

These structures are primarily established not for conducting business activities, but for:

Managing family wealth

Handling investment portfolios

Holding real estate and other properties

Ensuring long-term preservation and succession planning

Sometimes, such entities may earn incidental income related to wealth management

Such as interest on deposits,

Rental income from properties, or

uae-corporate-tax-taxation-of-family-foundations

Dividends on investments.

Key Insights

The ultimate beneficiaries of these incomes are the family members, and the entity is merely a vehicle for efficient management and administration. Under UAE Corporate Tax Law, these types of entities are referred to as “Family Foundations.”

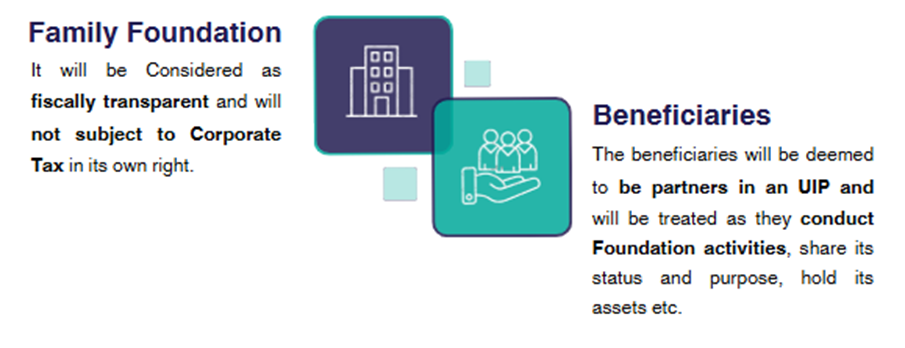

If such an entity is formed as a separate legal person, it would ordinarily be treated as a juridical person and be subject to Corporate Tax like any other business entity. However, it may apply to be treated as a tax-transparent Unincorporated Partnership for CT purpose subject to certain conditions.

Entity Types and Corporate

Tax Implications

key Insights

The above-mentioned entities, or any other entity of a similar nature, including any entity that is wholly owned and controlled by a Family Foundation, may apply to be treated as fiscally transparent — that is, not subject to Corporate Tax in its own right — by being treated as an Unincorporated Partnership (UIPs), provided the relevant conditions are met.

Conditions for Family Foundation to be treated as UIP

Beneficiary Condition

The Family Foundation was established for the benefit of

- Identified or Identifiable natural persons, and/or

- A Public benefit entity

Principal activity condition

The principal activity of the Family Foundation is to

receive, hold, invest, disburse,

or otherwise manage assets

or funds associated with savings or investment.

No Business Activity condition

The Family Foundation must not conduct an activity that would have constituted a Business or Business Activity if undertaken by a natural person.

No tax avoidance condition

The main or principal purpose of the Family Foundation should not the avoidance of Corporate Tax.

Distribution condition

The Family Foundation meets one of the distribution conditions where any of the beneficiaries are public benefit entities.

Analysis of Conditions for Family Foundation

1.1 Beneficiary condition

One of the key conditions for a Family Foundation to be treated as an UIP is that the beneficiaries of the foundation, trust, or similar entity must be either:

Identified Natural Person

Natural person who is explicitly named as a beneficiary in the charter, by-laws or an official documentation of the foundation or/and,

IDENTIFIABLE NATURAL PERSONS

Natural person who is not specifically named but falls within a defined class of beneficiaries, such as, a child or grandchild of the settlor or/and,

A Public benefit entity

An entity typically established for the welfare of the public and society and is not required to be a Qualifying Public Benefit Entity for beneficiary condition.

KEY Insights

There is no minimum or maximum number of beneficiaries required for a Family Foundation.

There are no restrictions on the relationship between the beneficiaries— natural person beneficiaries can belong to different families.

The term beneficiaries also includes indirect beneficiaries, such as the owners or beneficiaries of wholly owned fiscally transparent entities.

1.2 Principal activity condition

Another condition is that the principal activity of the foundation must be to receive, hold, invest, disburse, or otherwise manage assets or funds associated with savings and investments.

This includes, but is not limited to:

· purchasing and selling stocks or bonds,

· acquiring or disposing, leasing of real estate, and

· managing other assets intended to grow the value of the assets and/or generate an income stream for the beneficiaries.

1.3 No Business Activity condition

Another condition is that the foundation, trust, or similar entity must not carry out any activity that would be considered a Business or Business Activity if undertaken by a natural person. This requirement ensures that the primary purpose of holding the assets is for wealth management, and not for carrying on a business.

KEY Insights

Certain types of income are not considered to arise from a Business or Business Activity for the purposes of Corporate Tax in the case of a natural person. These include:

Wages

Personal Investment Income

Real Estate Investment Income

Accordingly, a Family Foundation may earn income from the above sources without being considered as conducting a Business or Business Activity for Corporate Tax purposes.

1.4 No tax avoidance condition

The main or principal purpose of a Family Foundation should not be the avoidance of Corporate Tax.

This condition may be considered as met if the below criteria are satisfied:

The primary objective of the foundation is to manage and preserve family wealth;

The foundation does not derive any income that is of a business or business activity nature; and

However, the intention of both the foundation and its beneficiaries will be assessed on a case-by-case basis, and the relevant authorities may examine the facts and circumstances to determine whether the foundation was established primarily to avoid Corporate Tax.

KEY Insights

An application to be treated as an UIP and thereby permitting income to be excluded from Corporate Tax would not in itself be seen as a tax avoidance purpose.

1.5 Distribution condition where beneficiaries include public benefit entities

This additional condition is applicable when any of the beneficiaries of the foundation or trust is a Public Benefit Entity (PBE)

Condition (A) shall be deemed to be satisfied if:

All the income derived by a beneficiary is exempt (e.g., dividends from a resident juridical person, income qualifying under the participation exemption, etc.); Or

The Public Benefit Entity is a Qualifying Public Benefit Entity

KEY Insights

As referred to above, the Foundation should not earn any income that would be considered as Taxable Income for the PBE if it were earned directly in its individual capacity.

Below are a few examples of income streams of a Foundation that may be considered taxable for the PBE:

Multi-tier structures

A Juridical Person can apply to be treated as an Unincorporated Partnership if:

1. It is wholly owned and controlled, whether directly or indirectly, by a Family Foundation

2. Meets all the conditions for Family Foundation to be treated as UIP (As discussed earlier in the document)

KEY Insights

Where ownership and control are indirect, they must exist through an uninterrupted chain of other juridical persons.

Both conditions must be met continuously throughout the relevant Tax Period of the juridical person.

There is no requirement for juridical persons within the uninterrupted ownership chain to have the same Financial Year.

Any entities within a multi-tier structure that are not fiscally transparent sucha juridical person that has either not submitted an application under Article 17(1) of the Corporate Tax Law or

does not meet the conditions specified therein

will result in a break in the uninterrupted fiscal transparency chain. Consequently, any juridical persons held by such fiscally opaque entities will also be ineligible to be treated as fiscally transparent under the Family Foundation provisions.

Corporate Tax Compliance Requirements for a Family Foundation that is treated as an UIP

Important Insights

A Family Foundation that is by default treated as an UIP (e.g., a trust formed by contractual relations) is still required to register for CT

However, where the entity is already treated as an UIP and thus is a tax-transparent entity by default, there is no need to make an application to the FTA for UIP status.

Where a foreign foundation, trust, or a similar entity has a presence in the UAE and meets the relevant conditions (including being treated as a juridical person), it may apply to the FTA to be treated as an UIP for Corporate Tax purposes.

Implications of Being Treated as an UIP

NATURAL PERSON AS BENEFICIARY

A beneficiary who is a natural person may not be subject to CT on their share of income distributed from the Family Foundation, if such income qualifies as Personal Investment Income or Real Estate Investment Income.

PUBLIC BEENFIT ENTITY (PBE) AS BENEFICIARY

- Qualifying PBE:- It will not be subject to CT, as it is treated as an Exempt Person.

- Non Qualifying PBE:- Entity will be treated as Taxable Person, and it must include its distributive share of income and expenditure from the Family Foundation in its Taxable Income.

- Foreign PBE:- Any foreign entity that was not previously a Taxable Person may become subject to UAE CT as a Non-Resident Person if the Family Foundation is treated as fiscally transparent and has a nexus in the UAE.

KEY TAKEAWAYS

The Beneficiaries should assess the eligibility of the foundation to apply for treatment as an UIP and should carefully that the foundation is not conducting any activity that may be regarded as a business activity of a natural person

If a foundation does not meet the conditions to apply for an exemption, or if it meets the conditions but chooses not to apply, it will be treated as a normal Taxable Person and will be subject to Corporate Tax in its own right

If a beneficiary provides services to the Family Foundation in their capacity as an independent service provider (not as a beneficiary or employee), and such services are wholly and exclusively for the Foundation’s activities, payments should be at arm’s length, and those services will be treated as separate from their role as a beneficiary.

If the Family Foundation is treated as an UIP, the standalone compliance requirements or applications under Article 16 of the Corporate Tax Law—such as applying to be a Taxable Person or registering as a UIP—will not apply to the Foundation.

In the case of multi-tier structures, where ownership and control are indirect, the chain of ownership must be uninterrupted and composed entirely of entities that are themselves fiscally transparent under the Corporate Tax Law.