VALUE ADDED TAX (VAT)Registration Exception

- Oct 30, 2025

- 6 min read

Value Added Tax (VAT) was introduced in the United Arab Emirates (UAE) on 1 January 2018 under Federal Decree-Law No. (8) of 2017 on Value Added Tax.

Under the UAE VAT Law, businesses are required to register for VAT upon crossing the mandatory registration threshold (AED 375,000 in the last 12 months), while they also have the option to register voluntarily upon meeting the voluntary threshold (AED 187,500 in the last 12 months)

Once a business receives its Tax Registration Number (TRN) and effective date of registration, it is considered a registered person under the UAE VAT regime and must comply with all VAT obligations — including filing tax returns (monthly or quarterly, as applicable), issuing tax invoices and credit notes, and maintaining proper VAT records.

However, the law provides an exception from VAT registration for businesses that are exclusively engaged in zero-rated supplies. If such a business obtains approval for a registration exception from the Federal Tax Authority (FTA), it is relieved from administrative obligations such as filing VAT returns and maintaining VAT compliance requirements.

This document provides a detailed overview of the eligibility criteria for applying for a VAT Registration Exception, the procedure for obtaining approval, the documentation requirements, as well as the conditions for deregistration, and the advantages and implications of opting for this exception.

VAT Registration and Exception

Under UAE VAT law, any person conducting taxable supplies in the UAE is required to register for VAT if the value of sales and/or imports into the UAE exceeds AED 375,000 within the previous 12 months, the company must apply for Tax Registration within 30 days.

Failure to register within this timeframe after crossing the mandatory threshold may attract a penalty of AED 10,000 for late registration.

For the purpose of calculating this threshold, sales include both standard-rated and zero-rated supplies.

Objective of VAT Registration Exception by FTA

Once a person’s VAT registration application is approved by the authority, the taxable person is required to comply with all provisions of the UAE VAT law, including, but not limited to:

Filing quarterly or monthly tax returns, as applicable.

Collecting and depositing VAT payments to the Federal Tax Authority (FTA).

Issuing tax invoices or credit notes, as applicable.

Any person exclusively engaged in zero-rated supplies (for example, export of goods or services from the UAE, international transportation, etc.) is still required to register for VAT upon reaching the threshold of AED 375,000. Such businesses, however, are not required to collect or remit VAT to the FTA.

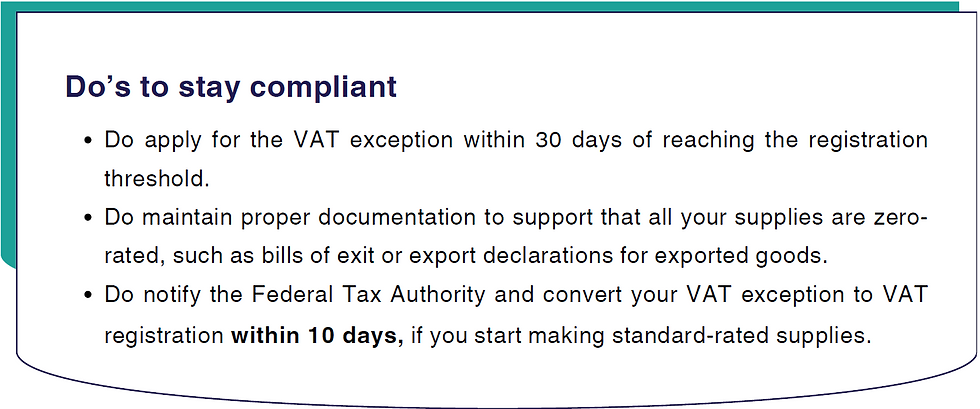

To reduce the administrative burden on businesses exclusively dealing in zero-rated supplies, the concept of a VAT exception was introduced. Under this exception, the business may file a VAT exception application (similar to a regular registration application) within 30 days of reaching the registration threshold. Once the exception is approved, the business is not required to file monthly or quarterly VAT returns or to raise Tax invoices.

Do’s and Dont’s

A taxable person will become ineligible for a VAT exception if they engage in even a single standard-rated supply or import of goods or services. It is therefore important for entities that have applied for a VAT exception to continuously monitor their supplies and ensure they remain eligible. If an entity undertakes any standard-rated sales or imports goods or services, it should immediately notify the Federal Tax Authority and take the necessary steps to convert the VAT exception to full VAT registration.

Pros of Applying for VAT Registration Exception

Reduced Administrative Burden

Businesses do not have to file periodic VAT returns or issue proper tax invoices complying with the VAT provision for zero-rated supplies.

Cost Savings

Businesses can avoid costs associated with VAT compliance, such as preparing and filing returns, maintaining accounting records in line with VAT requirements, and other related administrative expenses.

Cons of Applying for VAT Registration Exception

No Input tax Recovery

Businesses cannot reclaim VAT paid on purchases, which could increase operational costs.

Strict Eligibility Monitoring

Any standard-rated supply or import of goods/services immediately makes the business ineligible.

Applying for a VAT registration exception has both pros and cons, and the impact can vary depending on the nature of the business. Since applying for the registration exception is optional, businesses should carefully evaluate whether it is beneficial for them.

For example,

if an entity is primarily engaged in zero-rated supplies but incurs significant local purchases on which it pays input VAT, applying for the exception may not be advantageous, as it would forfeit the ability to recover that VAT. In such cases, registering for VAT and filing returns with refund applications would allow the business to reclaim the input VAT.

On the other hand, if a business has minimal input VAT in the UAE, it may prefer the simplified approach of applying for a VAT exception to reduce administrative burdens and compliance costs.

De-Registration

Article 21 of the VAT Decree-Law states that a Taxable Person shall apply for Tax Deregistration if:

The person ceases to make Taxable Supplies, or

The value of Taxable Supplies made over a period of 12 consecutive months is less than the Voluntary Registration Threshold of AED 187,500.

Further, as per the Executive Regulation, the Registrant must apply to the Authority for Tax Deregistration within 20 (twenty) Business Days from the date of occurrence of any of the above events.

The VAT Exception has been introduced by the Authority to ease compliance for taxpayers by relieving them from the requirement to file periodic VAT returns and undertake other administrative obligations.

However, it is essential to understand that zero-rated supplies continue to be treated as taxable supplies under the UAE VAT Law. Therefore, even if a person has been granted the VAT Exception, their FTA portal remain active, and they continue to be regarded as a taxable person.

Consequently, a taxable person benefiting from the VAT Exception must regularly monitor their monthly turnover (zero-rated supplies) to ensure continued eligibility. If the person’s annual taxable turnover falls below AED 187,500, or if they cease to carry on business activities, they are required to apply for VAT deregistration within 20 business days from the date of such occurrence, to avoid potential penalties for non-compliance.

Documents Required to apply for VAT Exception

Updated Trade License

Certificate of Incorporation (if available)

Memorandum of Association (MOA) / Article of Association (AOA)

Passport copy of all the shareholders and Authorized Signatory

Emirates id copy of all the shareholders and Authorized Signatory

Samples Sales invoices (signed and stamped)

Turnover Declaration (On letterhead, signed and stamped)

Business Flowchart (On letterhead, signed and stamped)

Declaration Letter (On letterhead, signed and stamped)

Contact Details (Email, Mobile Number, Office Address)

Bank details (Optional)

The process of applying for a VAT registration exception in the UAE is the same as submitting a VAT registration application.

During the registration process on the FTA portal, the business is required to complete the entire registration form, including all standard details such as business information, turnover, contact details.

However, within the registration form, there is a specific question asking whether the applicant wishes to apply for an exception from VAT registration.

The business should select “Yes” to this question if it is applying for exception.

Once the application is submitted, the FTA will review it and, if satisfied that all supplies are zero-rated and no standard-rated supplies are made, the FTA may approve the exception.

KEY TAKEAWAYS

VAT exception is optional, but once the registration threshold is reached, the taxpayer must mandatorily apply either for VAT registration or for a VAT exception within 30 days.

Even a single standard-rated supply or import of goods or services will make a business ineligible for a VAT registration exception.

Businesses should carefully assess whether applying for a VAT exception or full VAT registration is more beneficial, based on the nature of their operations and the amount of input VAT incurred.

Entities under VAT exception cannot recover input VAT, so this option is generally suitable only for those with minimal taxable expenses within the UAE.

Proper documentation and continuous monitoring of supplies are essential to ensure ongoing eligibility for the VAT exception.

Failure to notify the FTA promptly upon engaging in standard-rated activities may result in non-compliance penalties and retrospective VAT obligations.

Businesses must convert the exception into registration if they start making standard-rated supplies or imports within 10 business days.